[ad_1]

The U.S. dollar has become an all-too-convenient whipping boy for S&P 500

SPX,

corporations trying to explain why their earnings have come up short. You should take such explanations with a healthy grain of salt.

The U.S. Dollar Index

DXY,

has declined in recent months. Yet regardless of whether the the index was rising or falling, corporations complained. In October 2022, for example, corporations reported on the profits they earned when the dollar was soaring.

At that time, FactSet reported that 50% of S&P 500 companies were citing a “negative impact” from foreign exchange. Now, while early in the current earnings season, FactSet reports that 55% of S&P 500 companies are citing a negative impact from foreign exchange.

This isn’t to say that currency fluctuations will never affect a corporation’s bottom line. But for every company that is hurt by such fluctuations, another is helped. But you never hear about those companies. Better-than-expected earnings instead are invariably attributed to excellent execution on a brilliant corporate strategy. Earnings misses, on the contrary, are attributed to events out of a company’s control, such as the U.S. dollar’s fluctuations.

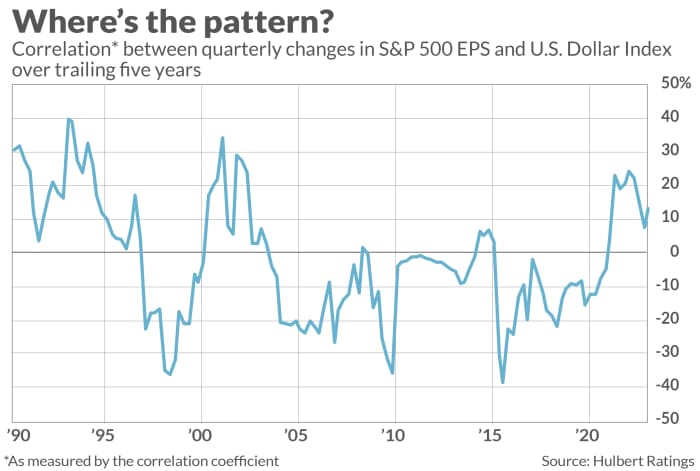

To paint a more objective picture of the dollar’s impact on corporate earnings, I searched for correlations between quarterly changes in the DXY and the S&P 500’s EPS since the early 1980s, four decades ago. I came up empty, at standard levels of statistical significance.

One of the more interesting patterns that did emerge is the wide variability in the relationship between the U.S. dollar and corporate earnings. There have been times over the past four decades in which their trailing five-year correlation was positive and others when it was negative. Knowing this doesn’t help you make money in the stock market, since you would first need to know whether we’re in a period in which the correlation is positive or negative.

To be sure, my simple statistical test won’t detect all the complex interrelationships between the various factors that affect both the dollar and profits. However, I did test several different econometric models that included as variables not just earnings and the dollar but also inflation and interest rates. The dollar didn’t have any statistically significant relationship with earnings in those more complex models either.

This doesn’t mean that the dollar’s fluctuations are irrelevant to an equity investor. But my results do suggest that there is no straightforward cause-and-effect relationship between the dollar and corporate earnings that leads to any simple mechanical rule for using the U.S. dollar to time the U.S. stock market.

International mutual funds

Note carefully that this discussion has nothing to do with the investment performance of international mutual funds. When the U.S. dollar declines against foreign currencies, a dollar-denominated investor in such funds enjoys a performance boost — capturing both the investment return of the funds themselves and also the return of the foreign currencies against the dollar.

This performance boost has been in full display since the beginning of last year’s fourth quarter, the date of the DXY’s two-decade high. Since then the dollar-denominated performance of the world’s stock markets outside the U.S. has beaten the U.S. stock market, as seen in the returns of the iShares MSCI ACWI ex-U.S. ETF

ACWX,

versus the Vanguard Total Stock Market ETF

VTI,

VTI].

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Plus: What the Eagles-Chiefs Super Bowl matchup can tell us about the stock market

[ad_2]

Source link